What Is The Additional Medicare Tax For 2025 Income. It’s a mandatory payroll tax applied to earned. Income up to a threshold amount is subject to the “regular” medicare tax.

If you anticipate having a liability for additional medicare tax for 2025, you may request that your employer withhold an additional amount of income tax. 6.2% social security tax on the first $168,600 of wages (6.2% x $168,600 makes the maximum tax $10,453.20), plus.

What Is The Additional Medicare Tax For 2025 Income Images References :

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

What is Medicare Tax Purpose, Rate, Additional Medicare, and More, Both employees and employers pay 6.2% on wages up to a $168,600 limit for 2025.

Source: jobiqnadiya.pages.dev

Source: jobiqnadiya.pages.dev

Medicare Tax Rate 2025 Caps Kyle Tomasina, The examples below are based on the.

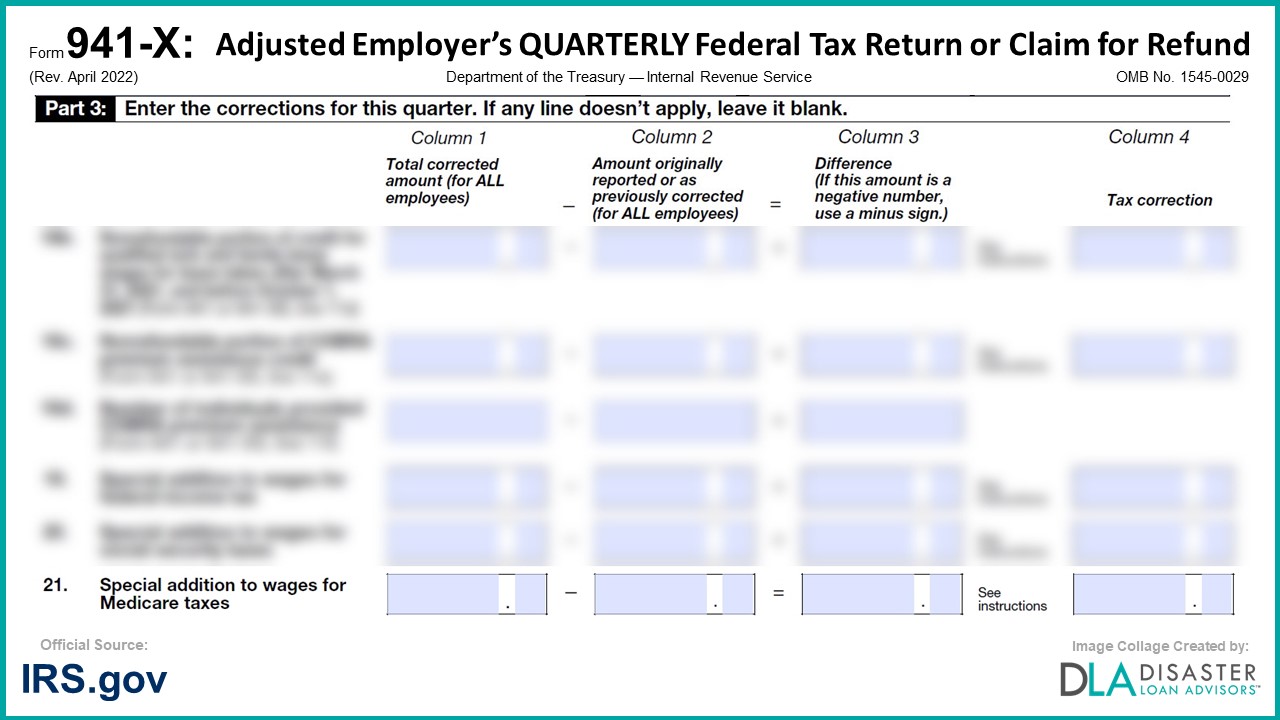

Source: www.disasterloanadvisors.com

Source: www.disasterloanadvisors.com

941X 21. Special Additions to Wages for Federal Tax, Social, If a freelance website designer earns.

Source: louisettewtove.pages.dev

Source: louisettewtove.pages.dev

Medicare Tax Brackets 2025 Chart Corri Doralin, Additional medicare tax withholding rate.

Medicare and Social Security updates for 2025 New Jersey Medicare Brokers, Specifically, the tax rates for futures & options (f&o) of.

Source: gayleqannetta.pages.dev

Source: gayleqannetta.pages.dev

Medicare High Tax 2025 Lily Shelbi, If you’re married, there are two different threshold limits.

Source: www.valuepenguin.com

Source: www.valuepenguin.com

What Is Medicare Tax? Definitions, Rates and Calculations ValuePenguin, The 2025 union budget introduced some modifications regarding the aadhaar card, stt, tds rate, and the direct tax vivad se.

Source: www.taxuni.com

Source: www.taxuni.com

Additional Medicare Tax 2025, There is no maximum wage limit for the.

Source: www.toppers4u.com

Source: www.toppers4u.com

Additional Medicare Tax Rate, Exemptions, Calculator and Form, Income up to a threshold amount is subject to the “regular” medicare tax.

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec.png) Source: careshealthy.com

Source: careshealthy.com

Why Do We Pay Medicare Tax Cares Healthy, You should file form 8959 if your.

Posted in 2025