Is Backdoor Roth Still Allowed In 2024. Is a backdoor roth ira still allowed in 2024? So if you want to open an account and then use the backdoor ira method to convert the account.

Yes, the backdoor roth ira is still allowed in 2024. Yes, mega backdoor roths are still allowed in 20234.

However, There Are Some Income Limits And Other Requirements That You Need To.

You’re usually allowed to withdraw contributions from your roth ira at any time, free of penalties or taxes.

For 2024, The Income Limit For Roth Iras Is $161,000 For Single Filers And $240,000 For Married Individuals Filing Jointly [0] Irs.

In what appears to be a significant change, the secure act 2.0 enacted in december 2022 did not have language eliminating the backdoor roth strategy in the drafting phase.

Finally, If You Plan To Use The Converted Funds Within Five Years, A Backdoor Roth May Not Be The Best Option.

Images References :

Source: odsonfinance.com

Source: odsonfinance.com

How to do BackDoor Roth IRA ODs on Finance, We cannot predict what will happen in the future, of course. Here's how those contribution limits stack up for the 2023 and 2024 tax years.

Source: markjkohler.com

Source: markjkohler.com

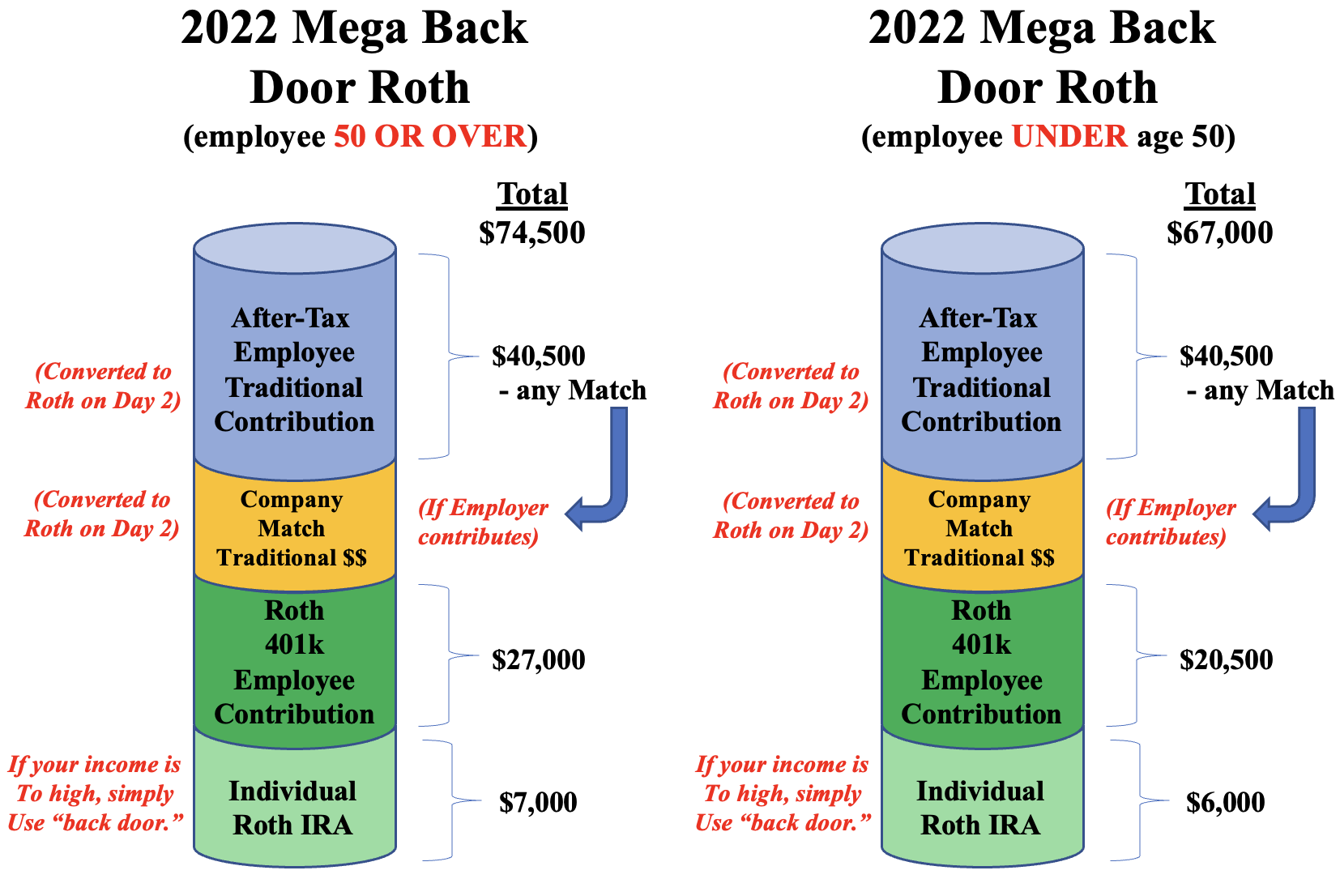

The Magic of the Mega Backdoor Roth Mark J. Kohler, Yes, mega backdoor roths are still allowed in 20234. Yes, backdoor roth iras are still allowed in 2024.

Source: www.daveramsey.com

Source: www.daveramsey.com

What Is a Backdoor Roth IRA?, We cannot predict what will happen in the future, of course. In 2024, the contribution limits rise to $7,000, or $8,000 for those 50 and older.

Source: insights.wjohnsonassociates.com

Source: insights.wjohnsonassociates.com

How To Use a Backdoor Roth for TaxFree Savings, The regular 401(k) contribution for 2024 is $23,000 ($30,500 for. Will the mega backdoor roth still be available in 2024 and beyond?

Source: managingfi.com

Source: managingfi.com

Mega Backdoor Roth My Step by Step HowTo Guide Managing FI, In what appears to be a significant change, the secure act 2.0 enacted in december 2022 did not have language eliminating the backdoor roth strategy in the drafting phase. Yes, the backdoor roth ira is still allowed in 2024.

Source: inflationprotection.org

Source: inflationprotection.org

how do backdoor roth ira's work Inflation Protection, Is a backdoor roth ira still allowed in 2024? Yes, even though the build back better act in 2004 was drawn up to end backdoor roth iras by 2020, this financial strategy remains in.

Source: www.adkf.com

Source: www.adkf.com

Is a Backdoor Roth IRA Right for You? ADKF, A backdoor roth ira may be particularly appealing to those who earn too much to contribute directly to a roth ira. While the mega backdoor roth strategy is currently allowed, it could be eliminated in the future,.

Source: mstonewealth.com

Source: mstonewealth.com

What Is the Backdoor Roth IRA? Milestone Wealth Management, Legal status of backdoor roth ira considering tax laws, a backdoor roth ira involves transferring funds from a traditional. A backdoor roth ira may be particularly appealing to those who earn too much to contribute directly to a roth ira.

Source: www.nerdwallet.com

Source: www.nerdwallet.com

How to Set Up a Backdoor Roth IRA NerdWallet, Is the backdoor roth ira still allowed? Here's how those contribution limits stack up for the 2023 and 2024 tax years.

Source: yourfinancialpharmacist.com

Source: yourfinancialpharmacist.com

Why Most Pharmacists Should Do a Backdoor Roth IRA, However, there has been talk of eliminating the backdoor roth in recent years. Backdoor roth iras are still allowed in 2024.

Here's How Those Contribution Limits Stack Up For The 2023 And 2024 Tax Years.

How much can you put in a mega backdoor roth in 2024?

Is Backdoor Roth Still Allowed In 2024?

The backdoor method allows those with higher incomes.