2025 Hsa Limits Contribution. The irs has released the 2025 hsa maximum contribution limits. Hsa high deductible limits 2025 over 55.

The 2025 hsa contribution limit for individual coverage increases by $300 to $4,150. In order to put money into an hsa you are required to have a high deductible.

In Order To Put Money Into An Hsa You Are Required To Have A High Deductible.

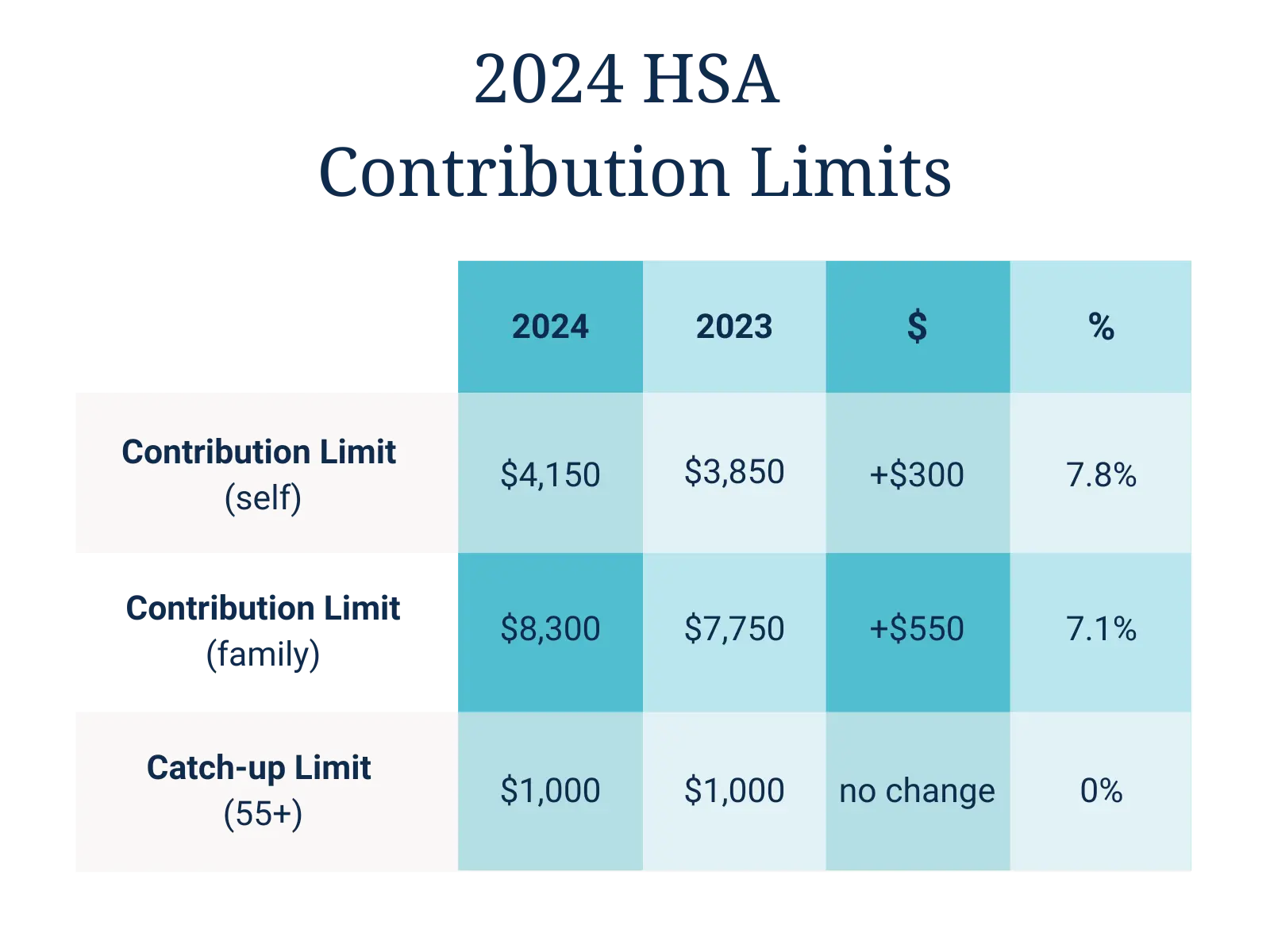

The hsa contribution limit for family coverage is $8,300.

The Health Savings Account (Hsa) Contribution Limits Increased From 2023 To 2025.

The annual hsa contribution limits for 2025 are $4,150 for individuals and $8,300 for families.

2025 Hsa Limits Contribution Images References :

Source: thomasinewjosee.pages.dev

Source: thomasinewjosee.pages.dev

Irs Hsa Rules 2025 Randi Carolynn, On may 9, 2025 the internal revenue service announced the hsa contribution limits for 2025. You must have an eligible.

Source: www.claremontcompanies.com

Source: www.claremontcompanies.com

2025 HSA Contribution Limits Claremont Insurance Services, On may 9, 2025 the internal revenue service announced the hsa contribution limits for 2025. Annual hsa contribution limits for 2025 are increasing in one of the biggest jumps in recent years, the irs announced may 16:

Source: www.newfront.com

Source: www.newfront.com

Significant HSA Contribution Limit Increase for 2025, For 2025, individuals under a high deductible health plan (hdhp) have an hsa annual contribution limit of $4,150. For 2025, you can contribute up to $4,150 if you have individual coverage, up.

Source: kimberleewanya.pages.dev

Source: kimberleewanya.pages.dev

Kancare Limits 2025 Roxy Wendye, The annual hsa contribution limits for 2025 are $4,150 for individuals and $8,300 for families. For 2025, individuals under a high deductible health plan (hdhp) have an hsa annual contribution limit of $4,150.

Source: tanabjoycelin.pages.dev

Source: tanabjoycelin.pages.dev

How Much To Contribute To Hsa 2025 Tildi Gilberte, Please note that the max contribution is different if you're. Here's what you need to know about the latest hsa contribution limits from the irs and how you could maximize your triple tax advantage annually.

Source: berthephyllida.pages.dev

Source: berthephyllida.pages.dev

Hsa Accounts For 2025 Timmy Giuditta, You must have an eligible. On may 9, 2025 the internal revenue service announced the hsa contribution limits for 2025.

Source: www.firstdollar.com

Source: www.firstdollar.com

IRS Makes Historical Increase to 2025 HSA Contribution Limits First, On may 9, 2025 the internal revenue service announced the hsa contribution limits for 2025. Hsa contribution limits 2023 and 2025, the hsa contribution limit for family coverage is $8,300.

Source: gwynethwbev.pages.dev

Source: gwynethwbev.pages.dev

Hsa Pre Tax Contribution Limits 2025 Tobye Leticia, Hsa high deductible limits 2025 over 55. Employer contributions count toward the annual hsa.

Source: timiqvallie.pages.dev

Source: timiqvallie.pages.dev

Hsa Yearly Contribution Limit 2025 Perle Brandice, The maximum amount of money you can put in an hsa in 2025 will be $4,150 for individuals and $8,300 for families. The hsa contribution limits for 2025 are $4,150 for individuals and $8,300 for families.

Source: gladiqwendye.pages.dev

Source: gladiqwendye.pages.dev

Irs Hsa Catch Up Contribution Limits 2025 Mandy Kissiah, You must have an eligible. The annual hsa contribution limits for 2025 are $4,150 for individuals and $8,300 for families.

The Annual Limit On Hsa.

Annual hsa contribution limits for 2025 are increasing in one of the biggest jumps in recent years, the irs announced may 16:

This Table Shows Historical Data For Hsa Contribution Limits From The Current Year All The Way Back To The First Year In 2004.

Hsa contribution limits 2023 and 2025, the hsa contribution limit for family coverage is $8,300.